The Frozen Foods

Landscape

U.S. consumers are choosing frozen food based on attributes such as affordability, convenience, nutrition, longer shelf life and food waste reduction.

The U.S. frozen food market is the largest in the world.(1)

Nearly half of American households have a secondary freezer beyond their primary refrigerator / freezer.(3)

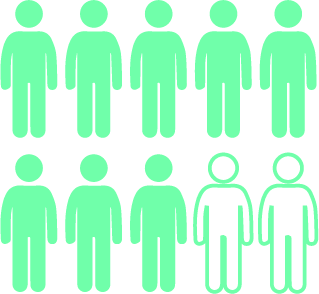

More than 8 in 10 Americans eat at least one frozen food item per week.(2)

Frozen vegetables remain one of the top frozen items Americans have on hand.(3)

U.S. consumers eat frozen food products an average of four times a week.(2)

U.S. consumers eat frozen food products an average of four times a week.(2)

1. Euromonitor International, data as of 12/1/2023. Market sizing includes all frozen categories.

2. Circana, LLC, National Eating Trends; Sourced In-Home/Retail. Data for year ending October 2023.

3. Circana, LLC, Kitchen Audit 2023.

Purchasing Behaviors

While nearly all U.S. consumers buy and/or eat frozen food, purchasing behaviors tend to differ based on household demographics and dynamics.1

Larger families, those with 4+ people in the home, are 24% more likely to purchase frozen food than the average household. That percentage increases dramatically as the household size grows.1

Those living in rural areas also frequently purchase frozen food. Many in this demographic have larger living spaces, own secondary freezers and, because they live further from grocery stores, may feel the need to stockpile frozen food.(1)

1. Euromonitor International, data as of 12/1/2023. Market sizing includes all frozen categories.

2. Circana, LLC, National Eating Trends; Sourced In-Home/Retail. Data for year ending October 2023.

3. Circana, LLC, Kitchen Audit 2023.

Generational Frozen Food Preferences(1):

Gen Z: more likely to choose variety, including sandwiches, breakfast sandwiches, and chicken.

Millennials: more likely to purchase chicken, appetizers, sandwiches, handheld entrees (e.g. burritos, quesadillas, corn dogs), and breakfast items from waffles to toaster strudels.

Gen X: 13% more likely to purchase frozen food than average consumer, values variety.

Boomer and Seniors: exponentially more likely to purchase pot pies, pies/pie crusts, whipped topping, frozen fish and frozen vegetables.

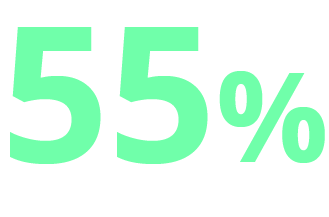

Empty nesters and senior couples: make Up 28% of frozen food purchases by dollar sales, driven by ease of preparation.

• Gen Z: age of head of household between ages 18 – 24

• Millennials: age of head of household between ages 25 – 44

• Gen X: age of head of household between ages 45 – 54

• Boomers: age of head of household between ages 55 – 74

• Seniors: age of head of household 75+

• Empty Nest couples: 2+ person households, no children, ages 54-64

• Senior couples: 2+ person households, no children, age 65+

1. Euromonitor International, data as of 12/1/2023. Market sizing includes all frozen categories.

2. Circana, LLC, National Eating Trends; Sourced In-Home/Retail. Data for year ending October 2023.

3. Circana, LLC, Kitchen Audit 2023.

Momentum behind the US frozen food industry

Prior to 2020, the frozen food industry was gaining momentum, due in large part to product innovation. During the Covid pandemic, frozen food experienced unprecedented growth due to how, what, where, and when people bought and consumed food and beverages. Even though the initial search of frozen food purchases normalized after the height of the pandemic, frozen food, volume sales remain above pre-Covid levels. In fact, U.S. frozen food volume sales were up 5% in 2023 compared to 2019 and have surpassed that of total food(1). Today, the U.S. frozen food industry generates:

$77.6 BILLION

IN ANNUAL SALES(1)

1. Calculation based on data reported by NIQ through NielsenlQ Spectra for the Frozen department for the Spectra Nov 2023 data package for all channels (United States) according to the NIQ standard product hierarchy. Copyright © 2024, Nielsen Consumer LLC.

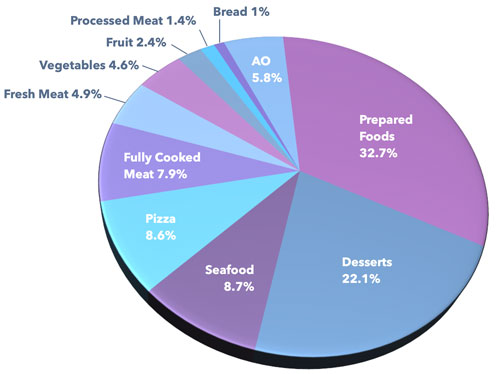

Frozen Dollar share by category(1)

Within the U.S. frozen food marketplace, the prepared foods category makes up the largest percentage of sales, growing 8% vs 4YA. Prepared foods consist of complete meals (single-serve and multi-serve), as well as potatoes, appetizers, sandwiches, breakfast sandwiches, burritos, and more*. In addition to Prepared Foods, Desserts, Seafood, Fully Cooked Meat, Fruit, and Bread, frozen categories are all outpacing the growth of total frozen.1

1. Calculation based on data reported by NIQ through NielsenlQ. Discover for the Frozen department for 52 weeks ending 12/02/23 for the Total US xA0C + Conv according to the NIQ standard product hierarchy. Copyright© 2024, Nielsen Consumer LLC.

*Full definition of prepared foods includes: food that has been prepared in a way that requires no preparation (i.e. washing, chopping, dicing, etc) by the end consumer. The top 10 categories that comprise Frozen Prepared Foods include Complete Meal, Potatoes, Appetizer, Sandwiches, Breakfast Sandwiches, Handheld Entrees, Waffle, Main course, Lasagna, Pot Pie (these categories make up -90% of the total Frozen Prepared Foods super category).

A Taste of Global Cuisine

The frozen food market is witnessing a surge in global cuisine options, meeting consumers’ demand for diverse, convenient meals.

Asian-inspired dishes like Sweet & Sour and Korean BBQ1 are popular, with brands like P.F. Chang’s driving growth1 in frozen appetizers.

Americans’ increasing appetite for spicy foods is reflected in sales, notably with sriracha-flavored products on the rise.

Indian flavors are also gaining traction, offering plant-based alternatives with bold tastes. Social media analytics predict continued growth in “hot” spices like arbol chili and gochujang.

Overall, frozen food is evolving to cater to consumers’ adventurous palates and lifestyle preferences.

Breakfast’s Frozen Foods Rise

The frozen breakfast category is experiencing significant growth, driven by consumers’ need for convenient and diverse options.1

Frozen breakfast sandwiches, especially popular among busy families, contribute $2.3 billion in sales(1), with croissant, burrito, and biscuit varieties leading the way.2

Additionally, frozen waffles, pancakes, and French toast are also growing segments, collectively amounting to billions in sales. Product innovation, such as high-protein and gluten-free options, is fueling further expansion. High protein products, in particular, are selling rapidly.

With breakfast emerging as a hot eating occasion, frozen breakfast foods offer time-saving solutions and a broader selection beyond traditional morning fare.

1. Calculation based on doto reported by NIQ through NielsenlQ Discover for the Frozen deportment for 52 weeks ending 12/02/23 for the Total US xAOC + Conv according to the NIQ standard product hierarchy. Copyright© 2024, Nielsen Consumer LLC.

2. Calculation based on data reported by NIQ through NielsenlQ Spectra for the Frozen deportment for the Spectra Nov 2023 data package for all channels (United States) according to the NIQ standard product hierarchy. Copyright© 2024, Nielsen Consumer LLC.

Mini Bites: Big Appetites

Small servings, like frozen bites and minis, are increasingly popular, with sales exceeding $1.1 billion last year.(1)

The appeal lies in factors like portion control, convenience, variety, and enjoyment, whether for sharing at social events or the visual appeal of miniature foods.

This trend mirrors the broader shift in American eating habits, with nearly half of consumers now snacking three or more times daily, reflecting an 8% increase in the past two years2 and contributing to a $200 billion snacking market.(3)

Internet searches for bites and minis have reached 3 million, reflecting interest in options like boneless chicken bites, mini tacos, and egg bites, along with homemade recipes for mini cheesecakes and energy bites.(3)

Fun & Convenient Kids’ Meals

Kid-friendly frozen foods have seen substantial growth in recent years due to their visual appeal, convenient preparation, and appealing flavors for children.

Brands like Kid Cuisine® exemplify this trend, combining easy prep with the popularity of bites and minis. Sales in this category now exceed $248 million annually, marking a 122% increase over four years.(1)

Parents prioritize nutrition, driving demand for products with clean labels, high protein, or whole grains, reflecting their efforts to provide balanced meals.(1)

This trend aligns with parental search data for easy-to-prepare meals that appeal to children’s tastes. Overall, kid-friendly frozen options cater to parental needs and children’s preferences alike.(2)

1. Calculation based a data reported by NIQ through NielsenlQ Discover far the Frozen department far 52 weeks ending 12/02/23 far the Total US xA0C + Conv according ta the NIQ standard product hierarchy. Copyright© 2024, Nielsen Consumer LLC.

2. Similarweb U.S. search engine data (desktop+mobile search volume) through November 2023.

Air Fryer Impact on Food Prep

The proliferation of kitchen innovations, particularly the air fryer, has revolutionized frozen food preparation. With 63% of households now owning an air fryer, up significantly from 20201, frozen food manufacturers are adapting, resulting in a 90% increase in products featuring air fryer cooking instructions.(2)

Chicken and potatoes, popular frozen items, dominate air fryer usage, followed by vegetables, fish, and frozen meals.(3) Brands like Gardein and Birds Eye offer products tailored for air fryer cooking, promoting healthier, oil-free preparation.

This trend reflects a shift towards convenient, healthier cooking methods, with air fryers enabling easy frying without excessive oil.

Notably, Americans are exploring air fryer recipes, with searches exceeding 185 million annually(4) focusing on salmon, chicken, potatoes, and more.

Air fryers are increasingly integral to American cooking routines, bridging the gap between frozen foods and healthier, more convenient meal options.

1. Circa, LLC, Kitchen Audit 2020 and 2023

2. Calculation based a data reported by NIQ through NielsenlQ Discover far the Frozen department far 52 weeks ending 12/02/23 far the Total US xA0C + Conv according ta the NIQ standard product hierarchy. Copyright© 2024, Nielsen Consumer LLC.

3. Circana, LLC, National Eating Trends; Sourced In-Home/Retail. Data for year ending October 2023.

4. Similarweb U.S. search engine data (desktop+mobile search volume) through November 2023.